India Export Growth Estimator

Projected Export Value Calculator

Calculate future export values based on current figures and growth rates from India's FY 2024-25 data.

| Category | Current Value | Projected Value (US$ Billion) | Ranking Change |

|---|---|---|---|

| Petroleum products | $45 | $45 | 1st |

| Gems and jewelry | $33 | $33 | 2nd |

| Pharmaceuticals | $29 | $29 | 3rd |

| Electronic goods | $22 | $22 | 4th |

| Textiles & apparel | $20 | $20 | 5th |

* Values based on current export data and growth rates from FY 2024-25.

When you hear "India's biggest export", many people picture textiles or jewelry. In reality, the crown belongs to a surprisingly different sector: refined petroleum. Below we unpack why petroleum products dominate India’s export basket, how the numbers stack up, and what this means for the country's manufacturing future - especially for the fast‑growing electronics arena.

What counts as an export?

Before we jump into the rankings, let’s clarify the rules of the game. An export is any good or service produced domestically and shipped abroad for sale. Government agencies like the Ministry of Commerce track these flows using the Harmonised System (HS) codes, which group similar products together. By looking at the latest data from the Ministry of Commerce & Industry (2024‑25 fiscal year), we can see the real picture.

Why petroleum products top the list

India doesn’t produce crude oil in large volumes, but it has built a massive refining capacity of over 300million metric tonnes per year. The country imports crude, refines it, and then sells the finished fuels - diesel, gasoline, aviation turbine fuel, and LPG - to over 70 destinations.

- Export value in FY2024‑25: US$45billion, a 12% jump from the previous year.

- Key markets: United Arab Emirates, United Kingdom, Hong Kong, and Singapore.

- Growth drivers: higher global fuel prices, tighter supply in the Middle East, and strong demand for cleaner diesel in Africa.

These figures eclipse the next‑best categories by a wide margin, confirming petroleum products as the undisputed leader.

Top five Indian exports by value (FY2024‑25)

| Rank | Export Category | Value (US$billion) | Annual Growth % | Main Destinations |

|---|---|---|---|---|

| 1 | Petroleum products | 45 | 12 | UAE, UK, Hong Kong, Singapore |

| 2 | Gems and jewelry | 33 | 8 | USA, UAE, Hong Kong, Israel |

| 3 | Pharmaceuticals | 29 | 14 | USA, EU, Africa, Middle East |

| 4 | Electronic goods | 22 | 9 | USA, EU, Vietnam, Bangladesh |

| 5 | Textiles & apparel | 20 | 6 | USA, EU, Middle East, Africa |

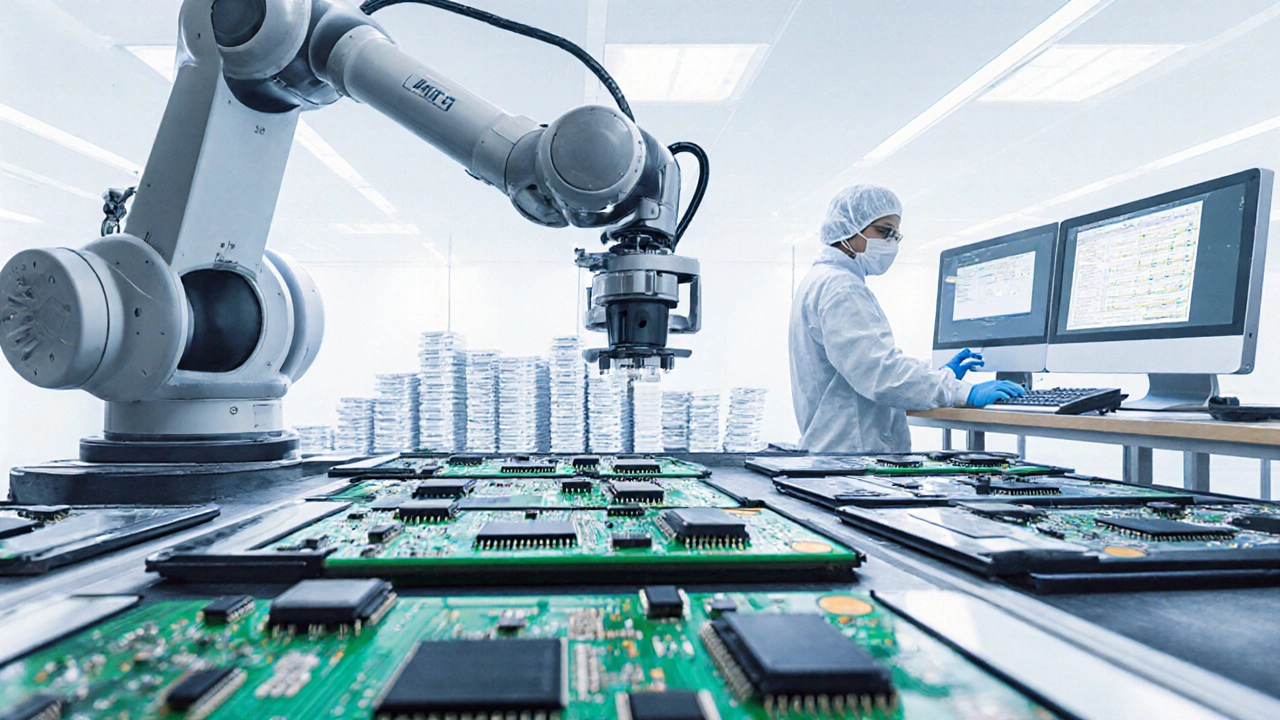

How electronics manufacturing fits in

Even though Electronic goods sit at fourth place, the sector is a key growth engine for India’s manufacturing push under the Make in India initiative. The government’s Production‑Linked Incentive (PLI) scheme for electronics, launched in 2022, promised a cumulative $30billion in incentives by 2026. Early results show:

- Domestic manufacturing capacity for smartphones grew from 30million units in 2021 to 70million units in 2024.

- Exports of circuit boards and telecom equipment rose 15% year‑on‑year.

- Foreign Direct Investment (FDI) in electronics manufacturing hit $5.8billion in FY2024‑25.

While still behind petroleum and gems, electronics is the fastest‑growing export segment, and its trajectory suggests it could break into the top three within the next five years.

Regional hotspots and supply‑chain basics

Export performance isn’t uniform across India. Certain states dominate specific categories:

- Maharashtra - powerhouse for petroleum refining (Mumbai, NaviMumbai), and a major hub for pharmaceuticals (Pune).

- Gujarat - leads in gems and jewelry, thanks to historic diamond cutting clusters.

- Telangana & Karnataka - hotbeds for electronics assembly and software services.

- Punjab & Haryana - key textile exporters, especially cotton‑based fabrics.

Understanding these clusters helps companies align with local talent pools, infrastructure incentives, and logistics hubs.

Policy levers shaping the export mix

Three government moves have a direct impact on why petroleum stays on top:

- Strategic Petroleum Reserve (SPR) policy - India’s decision to maintain a modest reserve forces regular crude imports, feeding refineries continuously.

- Export duty adjustments - the Ministry periodically lowers duties on refined fuels to keep them price‑competitive.

- Infrastructure upgrades - new port facilities at Paradip and Krishnapatnam cut shipping time, lowering logistics costs for bulk fuel.

For electronics, the PLI scheme and the “Electronics Manufacturing Cluster” (EMC) policy provide tax breaks, subsidised land, and faster customs clearance for components.

Future outlook: Will petroleum keep the crown?

Analysts from the International Trade Centre project a modest slowdown in petroleum export growth, averaging 4% per year through 2030, as the world shifts toward renewable energy. However, two factors could sustain India’s lead:

- Regional demand for diesel and jet fuel - Africa’s expanding economies and the Middle East’s aviation boom keep the market hot.

- Value‑added refinery products - petrochemicals (ethylene, propylene) are seeing higher margins and are slated for export growth.

Meanwhile, electronic goods are expected to grow at 12‑15% annually, driven by global chip shortages and India’s low‑cost assembly ecosystem. By 2030, electronics could overtake gems and possibly challenge petroleum for the top spot.

Practical takeaways for manufacturers and investors

If you’re a business looking to tap into India’s export strength, consider these steps:

- Map your product to the right state. For petroleum‑related services (e.g., logistics, refinery tech), Maharashtra offers the best ecosystem.

- Leverage government incentives. Check the latest PLI guidelines for electronics or the Export Promotion Capital Goods (EPCG) scheme for machinery.

- Partner with local exporters. Established firms have the customs clearance experience and market contacts needed to move goods quickly.

- Monitor global price trends. Fuel prices directly affect export profit margins; hedging strategies can protect against volatility.

- Invest in sustainability. Green certifications are becoming a prerequisite for European buyers across all categories.

By aligning with these practical moves, you can ride the wave of India’s export momentum, whether you’re in oil, gems, pharma, or the blooming electronics sector.

Frequently Asked Questions

What was India’s total export value in FY2024‑25?

India exported goods worth around US$630billion in FY2024‑25, with services adding another $280billion to the balance of payments.

Why does India export refined fuel instead of crude oil?

India lacks large crude reserves, but it has invested heavily in refining capacity. Importing crude and exporting refined products lets the country add value domestically and capture higher export prices.

Which Indian state leads electronics exports?

Telangana, particularly around Hyderabad, has become the frontrunner thanks to its PLI incentives and a strong software ecosystem.

How do government schemes support export growth?

Policies like the Production‑Linked Incentive (PLI), Export Promotion Capital Goods (EPCG) scheme, and reduced export duties lower costs for manufacturers and make Indian products more price‑competitive abroad.

Is the petroleum export sector vulnerable to the global shift toward renewables?

While demand for fossil fuels may plateau long‑term, India’s focus on petrochemical derivatives and regional fuel demand gives the sector a buffer. Still, investors are advised to diversify into cleaner energy projects.