Storage Unit Investment Calculator

Calculate Your Potential Returns

See how many units you need to break even and what returns you can expect

Your Facility Details

Your Costs

Your Investment Analysis

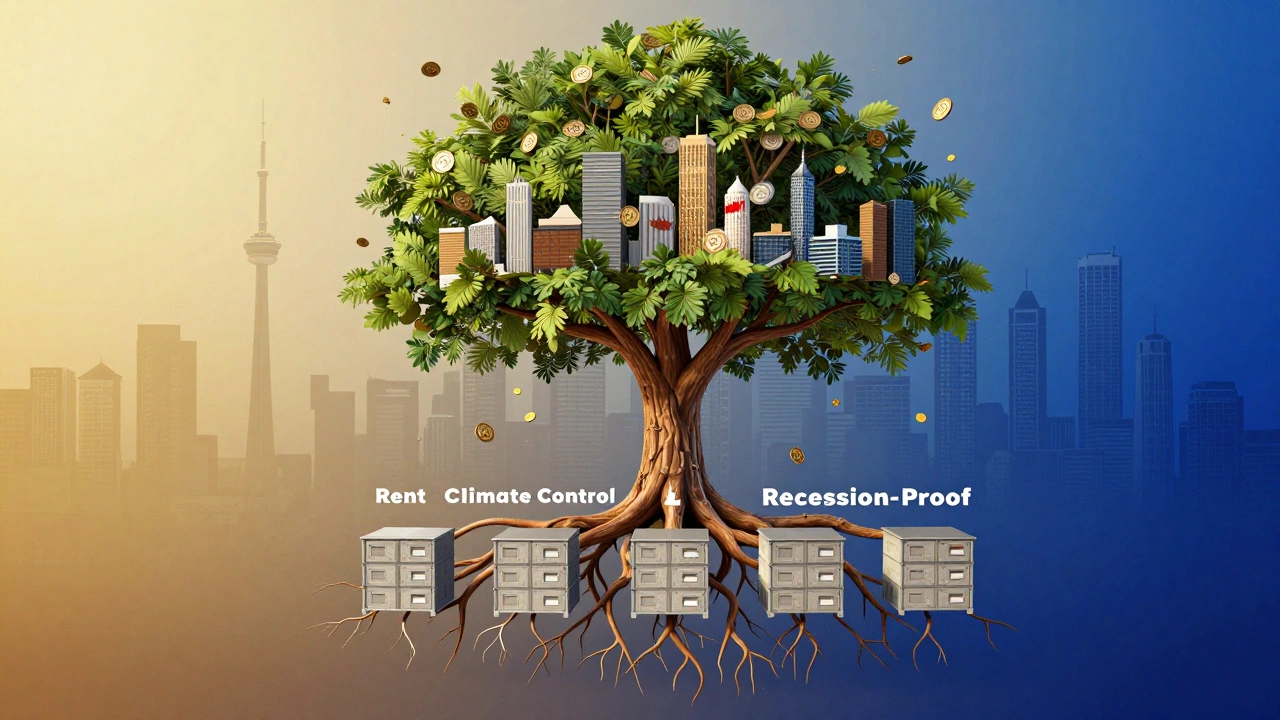

Buying a storage unit might sound like a weird way to make money-until you see the numbers. In 2025, the U.S. self-storage industry generated over $42 billion in revenue. Canada’s market isn’t far behind, with Toronto alone seeing over 12% annual growth in unit occupancy since 2020. This isn’t just about people running out of closet space. It’s about a steady, low-maintenance income stream that keeps working even when the economy stumbles.

Why storage units keep filling up

People move. People downsize. People renovate. People start businesses. And every time one of those things happens, they need a place to put stuff they can’t fit at home. Unlike rental apartments or retail spaces, storage units don’t require you to fix leaky faucets or deal with noisy neighbors. Tenants pay monthly, sign year-long contracts, and rarely complain-unless you charge too much.In Toronto, a 10x10 unit rents for $180-$250 a month. That’s $2,160-$3,000 per year, per unit. Multiply that by 50 units, and you’re looking at $108,000-$150,000 in annual gross income. And that’s before you factor in the fact that most units are 80-95% occupied year-round. Vacancy? It’s rare. Even during recessions, people still need to stash their furniture, tools, or holiday decorations.

What you actually pay for

Let’s say you buy a small storage facility with 40 units in Mississauga. The purchase price? Around $1.8 million. That includes the land, buildings, fencing, security system, and maybe a few climate-controlled units. Sounds steep? Here’s the catch: you don’t need to pay all of it upfront.Most buyers use a commercial loan. With a 25% down payment, your out-of-pocket cost is $450,000. Monthly mortgage? Roughly $8,000. Utilities, insurance, property taxes, and maintenance? Another $3,000. That’s $11,000 a month in fixed costs. Now look at your income: 40 units at $200 average rent = $8,000. Wait-that doesn’t cover it.

Hold on. That’s where you’re missing something.

Most facilities have more than just 10x10 units. You’ve got 5x5s for $80/month, 10x20s for $350/month, and maybe 20 climate-controlled units at $300/month. A well-balanced facility with 40 units might actually bring in $14,000-$17,000 monthly. That’s $168,000-$204,000 a year. After expenses, you’re clearing $80,000-$110,000 net. That’s a 17-24% return on your $450,000 investment.

It’s not all sunshine and storage bins

There’s a reason not everyone jumps into this. The biggest problem? Location. You can’t just buy any building with a fence and call it a business. A facility in a high-traffic area near a highway exit, close to apartment complexes, or near universities will outperform one tucked behind a gas station in a quiet suburb. Zoning laws matter too. Some cities limit how many storage units you can build on a single lot.Then there’s competition. In Toronto’s suburbs, there are now over 150 self-storage facilities within a 20-kilometer radius. If your facility looks outdated, has poor lighting, or doesn’t offer online payments, tenants will go elsewhere. Modern tenants expect mobile check-ins, 24/7 access, and security cameras. Upgrading a facility can cost $50,000-$100,000-but skipping it means losing tenants to newer competitors.

And then there’s the legal stuff. If someone stops paying, you can’t just kick them out. You have to follow strict lien laws. In Ontario, you must send notices, wait 30 days, and hold a public auction before you can sell their stuff. It’s a process. Mess it up, and you could get sued.

Who actually makes money here?

The biggest winners aren’t the people who buy one facility and call it a day. They’re the ones who buy multiple. A single facility might earn $100,000 a year. But if you own three? That’s $300,000. And if you hire a property manager for $40,000 a year to handle day-to-day tasks? You’re still ahead. Many investors treat storage units like a passive income engine-they buy, fix up, rent, and then repeat.Some even buy underperforming facilities for 30-40% below market value, upgrade them, and flip them for a 50-100% profit. One investor in Hamilton bought a 30-unit facility for $900,000 in 2022. He replaced the roof, added LED lighting, installed a new gate system, and raised rents by 20%. Two years later, he sold it for $1.6 million. No tenants were evicted. No major renovations were needed. Just smart upgrades and better marketing.

What you need to get started

You don’t need a degree in real estate. But you do need to know a few things before writing a check.- Check occupancy rates: Ask for the last 12 months of occupancy reports. Anything below 85% is a red flag.

- Look at rent trends: Are rents rising? Or have they been stuck at $150 for five years? Rising rents mean demand is growing.

- Inspect the property: Roof leaks? Fenced perimeter broken? Outdated security system? These cost money to fix.

- Ask about tenant demographics: Are most tenants students? Small businesses? Seniors downsizing? Each group has different needs.

- Understand local regulations: Some cities cap rent increases. Others require permits for signage or lighting.

Don’t skip the financials. Run the numbers yourself. Use a simple formula: Annual Gross Income minus Annual Expenses = Net Operating Income. Then divide that by the purchase price to get your cap rate. Anything above 8% is solid. Above 10%? That’s a bargain.

Storage units vs. other investments

Let’s compare storage to other common investments:| Investment Type | Average Annual Return | Management Effort | Liquidity | Downside Risk |

|---|---|---|---|---|

| Storage Units | 10-20% | Low (after setup) | Low (takes months to sell) | Low (recession-resistant) |

| Residential Rental | 5-8% | High (repairs, evictions, vacancies) | Low | Medium (tenant damage, rent control) |

| Stock Market (S&P 500) | 7-10% | None | High | High (market crashes) |

| REITs | 6-9% | None | High | Medium (interest rate sensitive) |

| Gold | 2-5% | None | High | Medium (no income, only appreciation) |

Storage units don’t pay dividends. They don’t go up in value overnight. But they don’t crash during market downturns either. When inflation hits, rents rise. When people lose jobs, they downsize. When interest rates climb, buying a house gets harder-and storage gets more popular.

Is it right for you?

If you’re looking for a hands-off investment that pays monthly, doesn’t require you to be a handyman, and holds value through economic swings-then yes, storage units are a good investment.If you want to get rich quick, or you hate dealing with contracts and legal paperwork, then skip it. This isn’t a get-rich-quick scheme. It’s a slow, steady, reliable way to build wealth over time.

Start small. Buy one facility. Learn the ropes. Then scale. The best investors I’ve met didn’t start with millions. They started with one unit, one tenant, and one smart decision.

Can you make money with just one storage unit?

Not really. A single unit rented at $200/month brings in $2,400 a year. After property taxes, insurance, and maintenance, you’re lucky to clear $1,000. Storage units only become profitable when you own a full facility with 20-50 units. One unit is just a storage locker. A facility is a business.

Do storage units appreciate in value?

Yes, but slowly. In high-demand areas like Toronto, Mississauga, or Ottawa, storage facilities appreciate 3-5% per year on average. That’s slower than housing, but more reliable. The value comes from consistent cash flow, not flipping. Buyers pay more for facilities with 90%+ occupancy and modern amenities.

What’s the biggest mistake new investors make?

They focus on the purchase price and ignore the operating costs. A $1 million facility with $150,000 in annual expenses isn’t better than a $1.5 million facility with $80,000 in expenses. Net income matters more than the sticker price. Always run the numbers before you sign anything.

Are climate-controlled units worth it?

In Ontario, yes. Winters are harsh, summers are humid. People storing electronics, antiques, documents, or musical instruments will pay 30-50% more for climate control. These units have higher occupancy and lower turnover. They’re not expensive to install if you’re building new. Retrofitting? That’s a $20,000-$40,000 project-but it pays for itself in 2-3 years.

Can foreigners buy storage units in Canada?

Yes. Non-residents can buy commercial real estate in Canada without restrictions. But you’ll need a Canadian bank account, a tax ID number (ITIN or SIN), and a local property manager. You’ll also pay higher interest rates on loans. It’s doable, but it’s easier if you’re already in the country.

If you’re thinking about this, start by visiting three local facilities. Talk to the managers. Ask how many units they’ve had to auction off in the past year. See how clean the place is. Notice if the gates work at midnight. If it looks well-run and full, that’s your model. Don’t chase the cheapest deal. Chase the busiest one.