Chemical Production Comparison Calculator

How Gujarat Dominates India's Chemical Industry

The article states that over 60% of India's chemical production happens in Gujarat. This calculator helps you visualize the scale difference between Gujarat and other major chemical-producing states.

Production Comparison

Insight from Article: Gujarat's chemical industry supports over 1.2 million jobs directly and 3 million indirectly. This is why it's called India's chemical heart.

Other states like Maharashtra, Tamil Nadu, and West Bengal have chemical industries, but they're significantly smaller due to less integrated infrastructure.

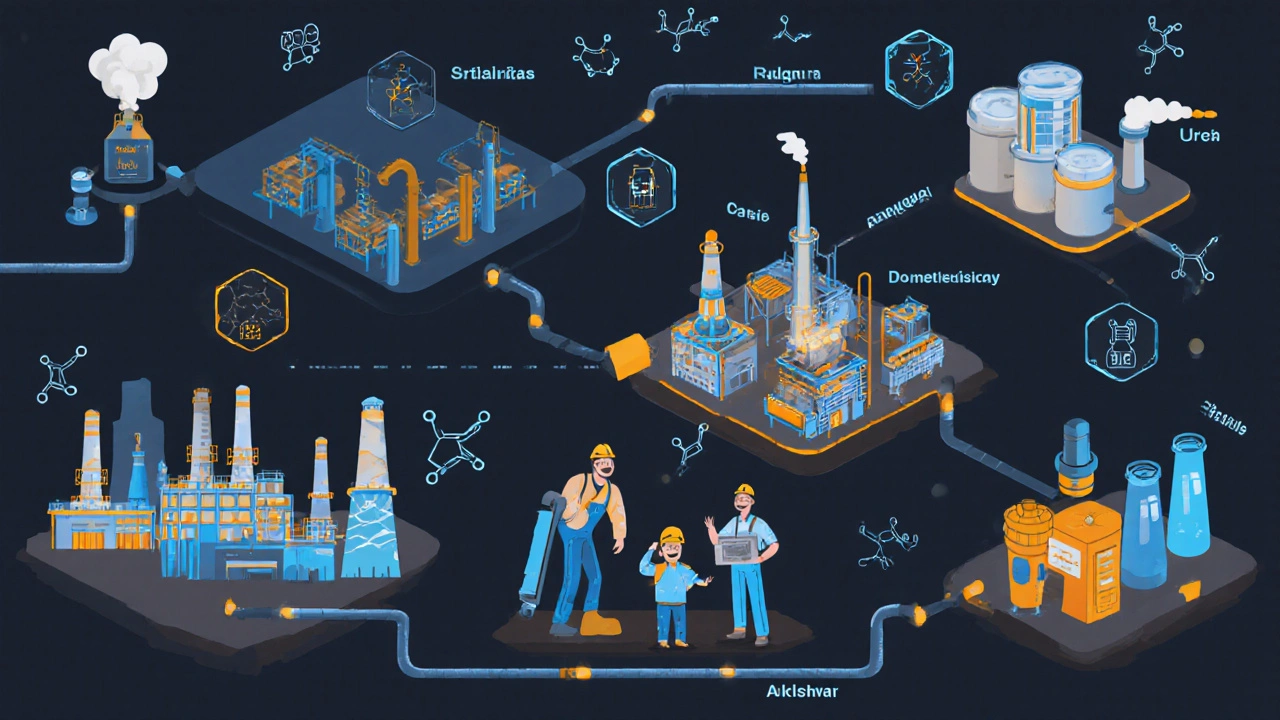

When you think of chemical manufacturing in India, one name stands out above all others: Gujarat. But not the whole state-specifically, the city of Jamnagar and the industrial belt stretching from Vadodara to Dahej and Hazira. This region isn’t just a player in India’s chemical industry; it’s the engine. Over 60% of India’s chemical production happens here, from basic petrochemicals to high-end pharmaceutical intermediates and specialty chemicals.

Why Gujarat Dominates India’s Chemical Sector

Gujarat’s rise as the chemical capital didn’t happen by accident. It was built on three pillars: access to raw materials, world-class infrastructure, and government support. The state sits right next to the Gulf of Khambhat, giving it direct port access for importing crude oil and exporting finished goods. Major refineries in Jamnagar-like Reliance’s, the largest in the world-supply the feedstock for thousands of downstream chemical plants.

Unlike other states that rely on scattered industrial parks, Gujarat has purpose-built chemical clusters. Dahej Special Economic Zone alone hosts over 120 chemical and petrochemical units. Hazira, near Surat, is home to companies like LG Polymers and Aarti Industries, producing everything from dyes to polymers. Vadodara, often called the "Manchester of Gujarat," has been a chemical hub since the 1970s, with giants like Gujarat Narmada Valley Fertilizers & Chemicals (GNFC) operating there.

The Key Players and What They Make

It’s not just about size-it’s about what’s being made. Gujarat’s chemical manufacturers don’t just produce bulk chemicals. They make the building blocks for global industries.

- Reliance Industries in Jamnagar produces ethylene, propylene, and aromatics-key inputs for plastics, synthetic fibers, and solvents.

- GNFC in Vadodara manufactures urea, ammonia, and formaldehyde, supplying fertilizers and industrial resins.

- Atul Ltd. in Ankleshwar specializes in pharmaceutical intermediates and dyes, exporting to over 80 countries.

- Aarti Industries in Tarapur makes specialty chemicals used in agrochemicals, cosmetics, and electronics.

These aren’t small operations. Reliance’s Jamnagar complex alone has a refining capacity of 2.2 million barrels per day and supports over 50 chemical plants. That’s more than the entire chemical output of many European countries.

Chemical Manufacturing Beyond Gujarat

While Gujarat is the undisputed leader, it’s not the only player. Other cities contribute significantly, but on a smaller scale.

- Mumbai and Thane in Maharashtra have a long history of dye, pigment, and pharmaceutical chemical manufacturing. Companies like Deepak Nitrite and Tata Chemicals have major plants here.

- Chennai and Parangipettai in Tamil Nadu are known for agrochemicals and specialty chemicals, with a strong focus on exports to Southeast Asia.

- Kolkata and Haldia in West Bengal host fertilizer and basic chemical plants, benefiting from port access and coal-based energy.

But none of these match Gujarat’s scale, integration, or export volume. Mumbai’s chemical sector is aging. Chennai’s is fragmented. Haldia lacks the pipeline network to compete with Gujarat’s seamless refinery-to-plant supply chain.

Infrastructure That Makes the Difference

What really sets Gujarat apart is infrastructure you can’t see but feel in every product made there.

- Integrated pipelines connect refineries to chemical plants, reducing transport costs and emissions.

- Seaports like Dahej and Hazira handle over 40% of India’s chemical exports.

- Power supply is reliable-many plants run on captive power plants fueled by natural gas from nearby fields.

- Water treatment facilities are built into every major chemical zone, meeting strict environmental standards.

In contrast, chemical plants in other states often face power cuts, delayed logistics, and water scarcity. Gujarat’s ecosystem is designed for efficiency. A company setting up a new plant here can get permits, land, utilities, and skilled labor in under six months. In other states, it can take two years.

Environmental and Regulatory Challenges

With great output comes great responsibility. Gujarat’s chemical belt has faced criticism over air and water pollution. In 2020, a gas leak at LG Polymers in Visakhapatnam (outside Gujarat) sparked national outrage. Since then, Gujarat’s government has tightened enforcement.

Today, every major chemical unit in Gujarat must pass environmental audits every six months. The Gujarat Pollution Control Board uses real-time monitoring systems for emissions and effluent discharge. Non-compliant units face shutdowns. Companies like GNFC and Atul have invested over ₹1,200 crore in green technologies over the last five years.

Still, the industry’s growth continues. New projects in the upcoming Dholera Smart City and the upcoming petrochemical park in Bharuch aim to double chemical output by 2030-while cutting emissions by 35%.

Who Benefits From Gujarat’s Chemical Hub?

The ripple effect is massive. Gujarat’s chemical industry supports over 1.2 million jobs directly and another 3 million indirectly. Farmers rely on its fertilizers. Textile mills depend on its dyes. Pharmacies stock medicines made from its intermediates. Even your smartphone’s plastic casing likely came from a plant in Hazira.

Global brands like BASF, Dow, and DuPont have set up R&D centers in Gujarat-not just to sell, but to co-develop products with Indian manufacturers. This isn’t just about making chemicals. It’s about building a global supply chain anchor.

What’s Next for India’s Chemical Industry?

India aims to become a $300 billion chemical industry by 2030. Gujarat is already at $120 billion and growing at 8% annually. The government’s Production Linked Incentive (PLI) scheme for specialty chemicals is pouring ₹10,000 crore into high-value segments like electronic chemicals and biodegradable polymers.

Startups are entering too. Companies like Chemofab and GreenChem Solutions are emerging in Surat and Vadodara, focusing on sustainable alternatives to traditional petrochemicals. They’re not replacing giants-they’re feeding them with niche, high-margin products.

The future isn’t just about more chemicals. It’s about smarter, cleaner, and more innovative ones. And Gujarat is leading that shift.

Is Jamnagar the only city famous for chemical industry in India?

No, Jamnagar is the most famous, but it’s part of a larger industrial belt that includes Vadodara, Dahej, Hazira, and Ankleshwar. Together, these cities form the core of India’s chemical manufacturing hub. Other cities like Mumbai, Chennai, and Haldia also have chemical plants, but none match Gujarat’s scale or integration.

What are the top chemical companies in Gujarat?

The top chemical companies in Gujarat include Reliance Industries (Jamnagar), Gujarat Narmada Valley Fertilizers & Chemicals (GNFC) in Vadodara, Atul Ltd. in Ankleshwar, Aarti Industries in Tarapur, and LG Polymers in Hazira. These firms produce everything from petrochemicals and fertilizers to dyes and pharmaceutical intermediates.

Why do chemical companies prefer Gujarat over other states?

Chemical companies prefer Gujarat because of its integrated infrastructure: direct port access, dedicated pipelines from refineries, reliable power, skilled labor, and fast-track environmental clearances. The state also offers tax incentives and has a proven track record of supporting large-scale manufacturing with minimal delays.

Does Gujarat produce pharmaceutical chemicals too?

Yes, Gujarat is India’s largest producer of pharmaceutical intermediates and active pharmaceutical ingredients (APIs). Companies like Atul Ltd. and Zydus Cadila manufacture over 70% of India’s exported APIs. Many global pharma brands source their raw materials from Gujarat because of its quality control and cost efficiency.

Are there any environmental concerns with chemical manufacturing in Gujarat?

Yes, there have been past incidents of pollution and accidents, like the 2020 gas leak in Visakhapatnam. But Gujarat has since strengthened its regulatory framework. All major plants now use real-time emission monitors, mandatory effluent treatment, and annual environmental audits. Many companies have shifted to cleaner technologies, reducing their carbon footprint by over 25% in the last five years.

If you’re looking to understand where India’s chemicals come from, start in Gujarat. It’s not just a city or even a state-it’s the beating heart of a global industry.